Residential Property Review – October 2025

| The housing market remains subdued, with buyer demand, listings and sales activity all slipping amid pre-Budget uncertainty | Landlord exits drive a sharp fall in rental supply, prompting RICS to forecast a 3% rent rise next year | The government plans to make reforms to speed home sales and cut fall-throughs, including digital property packs and conditional contracts |

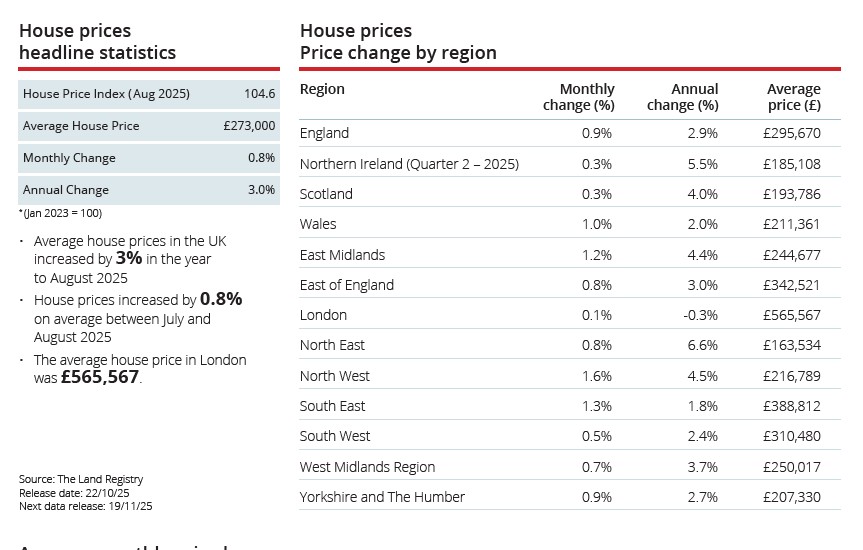

Residential market subdued

The housing market showed signs of subdued growth in September, according to the latest UK Residential Market Survey from the Royal Institution of Chartered Surveyors (RICS).

The report revealed that new buyer enquiries fell for the third consecutive month, with a net balance of -19% in September. Sales activity also remained in negative territory at -16%, although this marks an improvement on August’s figure of -24%. Meanwhile, new listings declined for the second month in a row, reaching -15%. This caution among buyers and sellers is likely due to the upcoming Autumn Budget, which has caused widespread uncertainty.

In the rental market, tenant demand remained broadly flat at -1%, however landlord instructions fell sharply to -38%, the lowest level since May 2020. This reflects an ongoing trend of landlords leaving the sector, leading to a continued imbalance between supply and demand. As a result, RICS expects rents to rise by around 3% over the next year.

Government proposes home-buying reform

The government has launched a consultation to overhaul the home buying and selling system.

It currently takes an average of 120 days to complete a transaction after an offer has been accepted, hence the need to make the process simpler, faster and more reliable.

One key proposal is to ensure that comprehensive information about a property is available at the point of listing. The government notes that this approach has helped to deliver ‘faster, more certain transactions in Scotland.’ To support this, there is a proposal for the widespread use of digital property packs, which would store current and historic details about a home.

As things stand, buyers and sellers can withdraw from a transaction at any point up until the exchange of contracts. To reduce fall-throughs, proposed reforms could include the use of conditional contracts, which would make the transaction binding at an earlier stage. If a party withdrew, they would typically face a financial penalty.

Britain’s best new building

Appleby Blue Almshouse in Southwark, south London, has won the 2025 Royal Institute of British Architects (RIBA) Stirling Prize for Britain’s best new building.

Designed by Witherford Watson Mann, the development reimagines the traditional almshouse to address loneliness and provide affordable, high-quality housing for people over 65. The complex contains 59 flats alongside communal areas, including a courtyard, roof garden and community kitchen, all designed to foster connection and wellbeing.

Judges praised the project for ‘setting an ambitious standard for social housing among older people,’ with jury member, Ingrid Schroder, highlighting its “high-quality” and “thoughtful” design that “truly cares for its residents.”

Features such as terracotta-paved hallways with benches and plants, and a central water feature, create what RIBA described as an ‘aspirational living environment’ that contrasts sharply with the ‘institutional atmosphere often associated with older people’s housing.’

All details are correct at the time of writing (22 October 2025)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission